Originally published: June 3, 2024

Myth: Oil and gas mergers are bad for America because they make oil more expensive.

Truth: Oil and gas mergers are good for America because they increase domestic production, which makes oil cheaper and increases our national security. Government should get out of the way immediately.1

-

The last few years should have made clear that our prosperity and security depend on having robust domestic oil and gas production.

E.g., Biden restricted oil production, then, when prices rose, felt compelled to dangerously drain the Strategic Petroleum Reserve and beg Saudi Arabia and Venezuela for oil.

How Biden’s abuse of the Strategic Petroleum Reserve to win votes harms our energy security

-

Instead of reversing course on its anti-oil-and-gas agenda, the Biden administration has added yet another deadly component of it: opposing domestic oil and gas mergers.

-

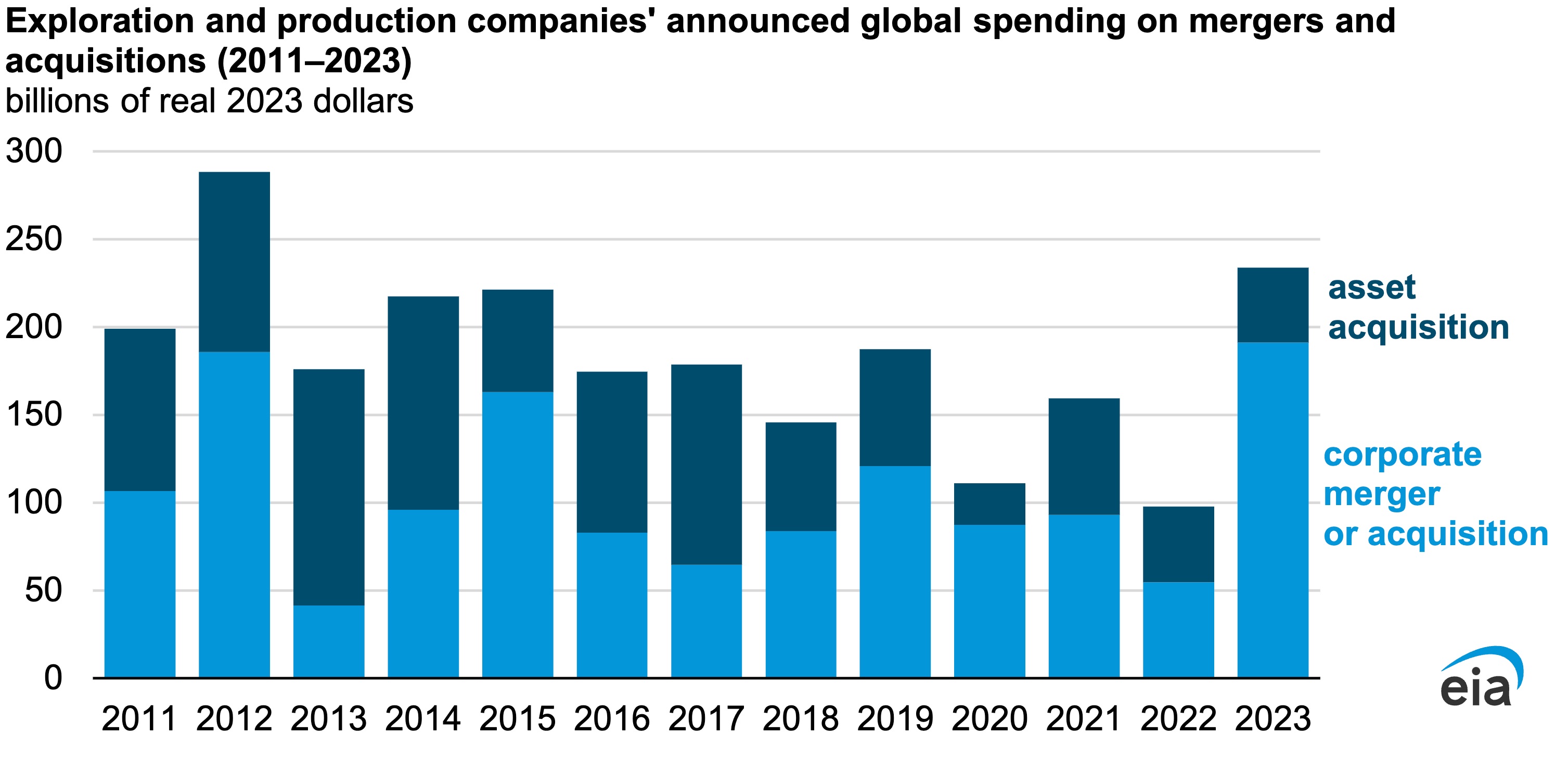

Many top American oil and gas companies have sought mergers and acquisitions in the last year to become more efficient and profitable.2

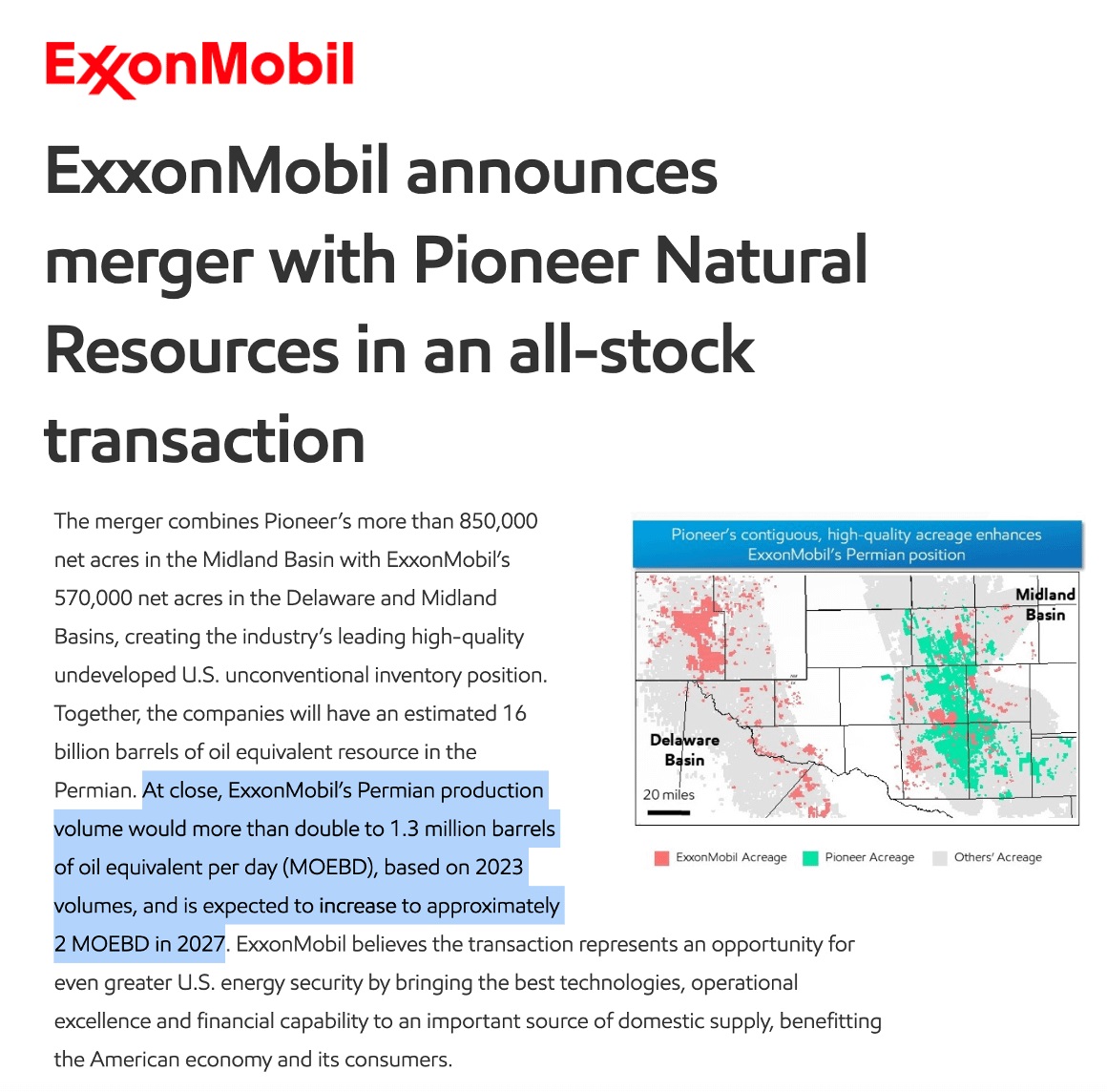

These include Exxon (to acquire Pioneer), Chevron (to acquire Hess), Diamondback (to acquire Endeavor), and Oxy (to acquire Crownrock).

-

When companies merge it means their leaders believe the combined company will produce oil from existing deposits more cheaply and/or in greater quantities.

E.g., Exxon expects acquiring Pioneer will increase production from their combined assets in the Permian by over 50% by 2027.

-

When companies merge it often means their leaders believe the combined company, with a better balance sheet, will be better able to invest in new deposits and make them highly productive—another benefit to domestic production.

-

While critics of mergers decry oil profits, the profitability of oil and gas mergers is what makes them good for America. More profit means operations are more efficient, enabling production of more and/or cheaper US oil.

-

The more cheap oil and gas we produce in America, the more we get energy security for us and our allies, the more domestic prosperity we have, and the more job opportunities we have, both in the energy industry and in the myriad industries that benefit from lower energy prices.

-

Despite the seemingly obvious fact that a more efficient and productive American oil and gas industry is better for Americans, the federal government is threatening to stop recent oil and gas mergers and at minimum imposing costly delays.

-

Following a Nov 2021 letter from Biden to FTC Chair Lina Khan asking her to crack down on mergers due to “mounting evidence of anti-consumer behavior by oil and gas companies,” the FTC has increasingly delayed and threatened efficiency-increasing oil and gas mergers via prolonged investigations.3

-

Per the Hart-Scott-Rodino (HSR) Act, FTC conducts a 30-day review of companies’ pre-merger plans to determine whether the merger might “harm competition.” Then the FTC can automatically delay mergers by up to a year or more by submitting a “Second Request” for more information.4

This is a tremendously dangerous power.

-

In just the last 6 months, several of the biggest oil and gas deals of the decade including Exxon-Pioneer, Chevron-Hess, Diamondback-Endeavor, and Oxy-Crownrock have received “Second Request” notices from the FTC, delaying each merger by at least 6 months.5

-

Even if the FTC eventually lets a merger through, a delay alone is harmful. Companies lose valuable time, spend a fortune on lawyers, get distracted from their core work, and the merger’s efficiency benefits are delayed.

-

In some cases FTC allows mergers but adds an unjust punishment.

E.g., FTC allowed the Exxon-Pioneer merger, but barred former Pioneer CEO Scott Sheffield from Exxon’s board in light of allegations that Sheffield had engaged in “anti-competitive” schemes in public (!) communications.6

-

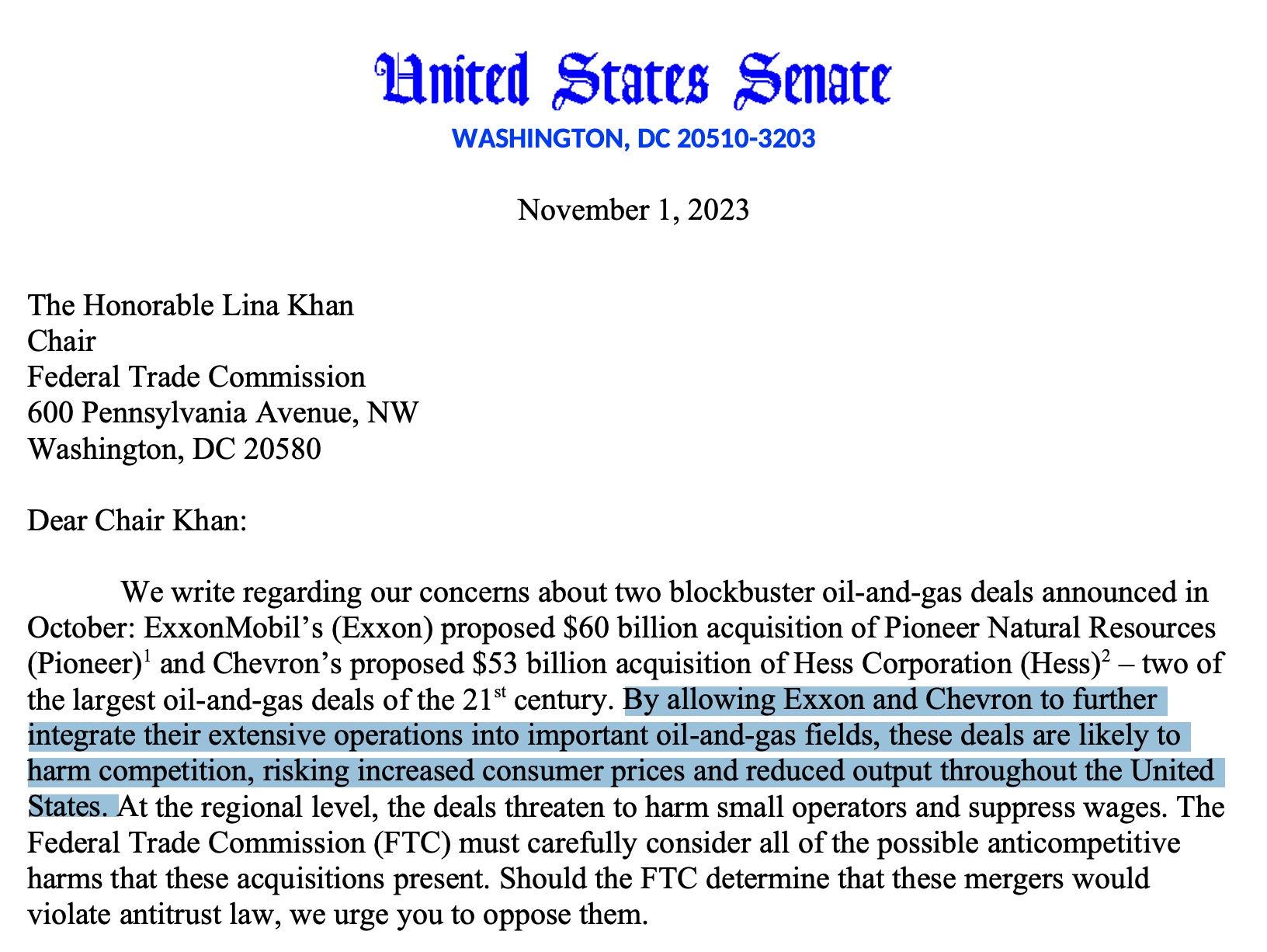

FTC justifies throttling efficiency-improving oil and gas mergers with the argument—as exemplified by 23 Senators in a letter to the FTC—that they enable oil and gas companies to engage in “anticompetitive” schemes to artificially reduce supply, raising oil prices for American consumers.7

-

The notion that oil and gas mergers allow companies to engage in “anticompetitive” schemes to manipulate prices is nonsense.

Oil and gas is sold on the global marketplace, where individual American companies have no power to set prices.

-

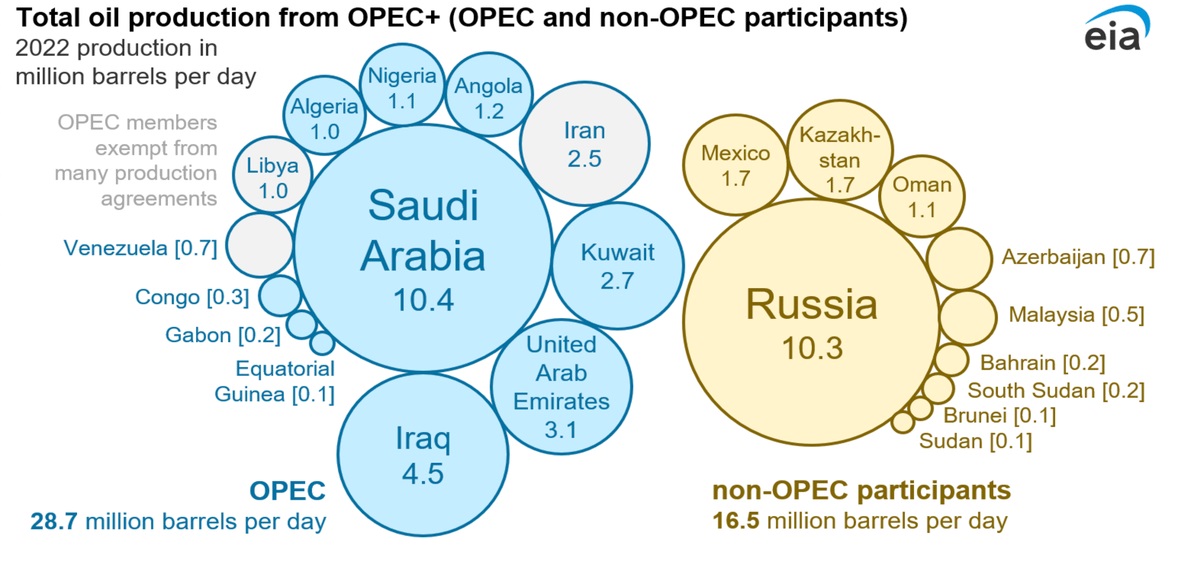

In the OPEC+ dominated global marketplace for oil and gas, no American oil and gas company is anywhere close to dominating production. E.g., Post-merger ExxonMobil, America's biggest oil and gas company, will account for less than 3% of global production.

-

The OPEC+ cartel, which produces 60% of the world's oil, can plausibly increase global prices by cutting their portion of supply—but the largest US oil and gas company, producing a relatively tiny portion of world's oil, has no such power.8

-

In practice, in order to increase profits US oil and gas companies cannot cut production; they must lower costs, increase production of assets, and/or invest in new assets—all of which have a lowering effect on price.

-

Oil and gas mergers do not pose a threat to oil and gas prices, but government actions that restrict or prevent these mergers do.

Fewer mergers means less efficient production, which give OPEC+ dictatorships even more control of prices.

-

The Biden administration's attack on oil and gas mergers on the grounds that this will lower gasoline prices is both wrong and clearly disingenuous. Their explicit goal is “net zero”—the elimination of fossil fuel use, including gasoline use, by making it illegal or ruinously expensive.

-

While Biden has been in office, his administration has relentlessly attacked oil investment, oil production, and oil transport—leading to higher prices and lower security. But instead of taking credit for their “success,” the administration denies that it’s anti-oil-and-gas.9

-

By encouraging FTC to attack oil and gas mergers, while waging a broader all-of-government war on fossil fuels, the Biden administration is clearly pursuing their goal of making gasoline and all other fossil fuels unaffordable to reach “net zero.” They should admit it.

-

Biden should direct the FTC to stop all anti-oil-and-gas-merger activity—recognizing this is absurd given the nonexistent control any oil and gas company has over prices—and welcome whatever mergers companies and shareholders decide will make them more efficient and American oil and gas more prolific.

Michelle Hung and Steffen Henne contributed to this piece.

References

-

Hart Energy - FTC Strikes Again: Diamondback’s $26B Endeavor Merger Delayed↩

-

U.S. EIA - M&A activity in 2023 furthers consolidation of U.S. crude oil and natural gas firms↩

-

U.S. FTC - Hart-Scott-Rodino Antitrust Improvements Act of 1976↩

-

Reuters - Diamondback Energy and Endeavor receive second FTC request over $26 bln deal↩

-

Senate Democrats - Schumer, Senate Democrats Call On DOJ To Immediately Launch Full Court Press Against Big Oil To Prevent And Prosecute Collusion & Price Fixing↩

-

U.S. EIA - What is OPEC+ and how is it different from OPEC?↩